As healthcare costs continue to rise, retirees stand to lose a ton of money if they don’t consistently re-shop and compare their Medicare Supplements. In this article, we’ll show just how much you can save by reshopping your Medicare Supplement every three years. We’ll even break down the math and show you how a 65-year-old couple can save almost $90,000 over their retirement!

CAVEAT:

It’s very important to understand that this is a best case scenario, assuming your health is good enough to pass underwriting in order to switch Supplements. If, for whatever reason, your health deteriorates to the point that you can’t pass underwriting, that will curtail the potential savings from reshopping your Supplement.

HOWEVER:

ANY savings you can get by switching NOW, when you’re still healthy enough to pass underwriting, will go a long way to pad your financial future, as shown in the math below.

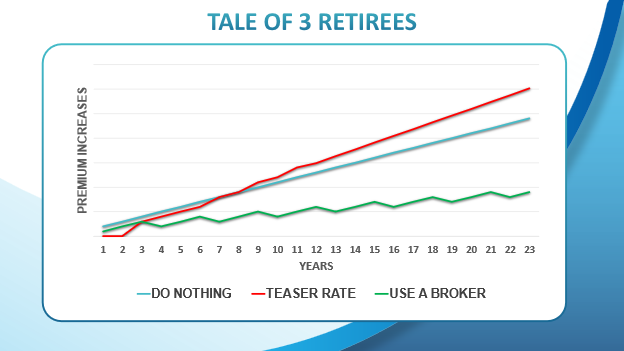

Why Switch So Often?

It’s nice to just set it and forget it, not having to tinker with frequent changes – that’s probably one of the top reasons why you got a Supplement in the first place! But complacency will be costly if you’re not proactive about periodically reshopping your rates.

More than 90% of retirees on a Medicare plan do not change plans or recheck their options. Since Medicare Supplements never change their benefits (unlike Medicare Advantage plans which may change every year), it’s easy to just pick a plan and put it out of mind, right?

Let’s see how much that assumption could cost you in the long run.

Calculating the Savings

ASSUMPTIONS:

- Let’s say a 65-year-old retiree goes on Medicare.gov and chooses a Supplement plan from a popular company she saw on TV.

- It’s not the cheapest plan, but it’s not the most expensive, either.

- Curious to know if there’s a better option, this conscientious retiree double checks with an independent broker after hearing rave reviews about him from a friend, family member or neighbor.

- Since she’s still in the first three months of getting Part B, she doesn’t have to go through underwriting.

- Initially, the retiree saves $35 a month by switching to a more competitive A-rated company.

Now, there’s some HUGE confusion about calculating potential savings. Most retirees forget that any savings they get from switching their Supplement carries on throughout the rest of their life. Think about a retiree who NEVER changes her Supplement compared to someone who switches when he first goes on Medicare. If the average life expectancy is 87, then that’s 264 months that a retiree will be paying a monthly premium for their Supplement.

- 87 years minus 65 (when a retiree first goes on Medicare) = 22 years

- 22 years is 264 months (22×12=264)

If a retiree changes her plan a month later after turning 65 and going on Medicare, then that’s 263 months of paying lower premiums compared to someone who never changes. Even if she only saves $35 a month by switching her Supplement, she’ll end up saving a total of $9,205 over her retirement. (263x$35=$9,205)

Just imagine if the retiree initially chose a more expensive company (just because she saw it on TV) and saved $50 or $100 a month by switching plans? Saving $50 a month, compared to someone who never reshops their Supplement for the rest of their lives, would total $13,150. And saving $100 a month would total $26,300 over their retirement!

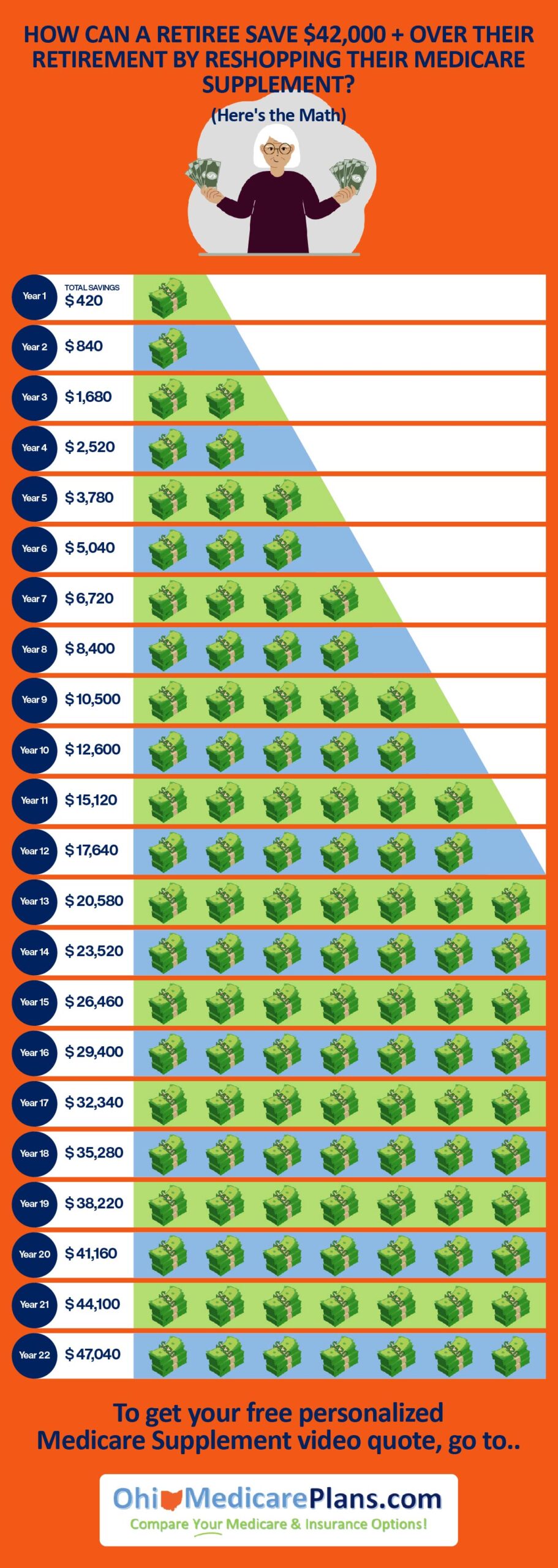

So, How Do You Get $42,000 in Savings?

Let’s just assume we can only save you $35 a month initially. Then, through reshopping your rates every three years down the road, we find an additional $35 a month in average savings.

This means that every three years, you’ll stack an ADDITIONAL $35 in monthly savings ($420 in annual savings) on to the previous years of savings you incurred compared to a retiree who never changes their plan to save money. So, if you compare saving an extra $420 a year, every 3 years, to someone who never changes their plan, as each year goes by and their costs continue to go up – then you’ll see that using a broker will help moderate these costs as you get older and your rates keep getting higher.

Think of it this way…

It’s almost like walking into a gas station, buying a lottery ticket and winning $35 per month for the rest of your life! You’ll always get to enjoy that extra $35 a month or $420 a year compared to someone who never won the lottery (or, in this case, switched their Supplement).

But instead of just getting lucky once, we get to repeat these savings every 3 years (provided you’re healthy enough to pass underwriting). That’s like walking back into the same gas station again and scratching off another winner – stacking every round of savings on to the last.

Here’s the math breakdown:

If you’re a 65-year-old COUPLE, then you could theoretically double these savings! And of course, you could save even more over time if you save more than $35 a month when we FIRST switch your Supplement – and that’s because the initial savings will carry over your whole retirement, compared to a retiree who stays on the same plan, overpaying for the rest of their life.

You’ll notice in the infographic that the potential savings plateau at year 15 instead of stacking additional savings from switching your Supplement again. This illustrates the likelihood that soon or later everyone’s health deteriorates to the point that they can’t pass underwriting to keep switching Supplements anymore.

While some seniors may maintain amazing health into their 80’s, saving even more than $42,000, I don’t want to suggest that this is a likely outcome. Most retirees stop changing their Supplements around year 15, which makes them around 80 years old in our example. If you’re older than 65 when switching your Supplement, the potential savings illustrated above might be less, especially if your health makes it hard to switch Supplements in the future.

Is This Realistic?

There is a litany of reasons why these projections might not actually work out this way:

- You could get sick. Looking at the health demographics of this country, it isn’t realistic that many retirees will maintain their health long enough to pass underwriting requirements to keep switching their Supplements. This is where an independent broker can be invaluable because we can compare and shop more companies than an agent who only represents a single company. The more companies you compare, the better your chances of finding a company that might take your health conditions and still offer savings.

- Medicare goes bankrupt. We see and hear about this every year. If Medicare does go bankrupt, what will most likely result is a restructuring of plans and benefits to shore up costs. Medicare Supplements may cease in their current form entirely. Of course, this is pure conjecture, as no politician or agency has spoken about any changes other than general bankruptcy, besides possibly increasing the age when seniors can go on Medicare.

- Reshopping your plan less often. It depends on how the state dynamics change regarding the number of Supplement companies. If companies start to exit the market or consolidate, there may fewer choices to choose from, potentially decreasing the number of chances available to switch your Supplement.

- You’re a brand-new client of ours. Maybe you found us when you were 72 or 80 years old. That would cut down considerably the number of opportunities to save money by switching your Supplement, compared to someone who finds us when they’re 65 years old.

Regardless of the reason, if you’re healthy enough, depending on your age, your savings could range from $9,205 to $47,040 or more. That’s FAR TOO MUCH MONEY TO LEAVE ON THE TABLE!

Wouldn’t you rather put that money back in your own pocket instead of lining the pockets of some insurance company executive? Isn’t living on a fixed income in these inflationary times becoming more challenging every year? Well, it doesn’t have to be if we keep finding you savings by making sure you don’t overpay on your Medicare Supplement.

Reach out to us to see how much monthly savings you qualify for!